Best brokerage firm in India 2024

There is only one side to the stock market, and it is not the bull side or the bear side, but the right side.

Discount Broker vs Full Service Broker – Why Costs Matter

The pessimism around the Union Budget was unfounded as it has been received with tremendous vitality, and its influence on markets has been far-reaching. Nifty crossed 15,000 for the first time in its existence, and the market has shown no signs of tiring. 2020 and the lockdown for most of the year exposed people to the stock markets as everybody felt the need to invest in securing their future, and the markets presented a buying opportunity at just the right time. For several first-time investors looking to dip their toe in the sea of stocks, the first step is to open a brokerage account, and the idea is to open the same with the best brokerage firm in the country.

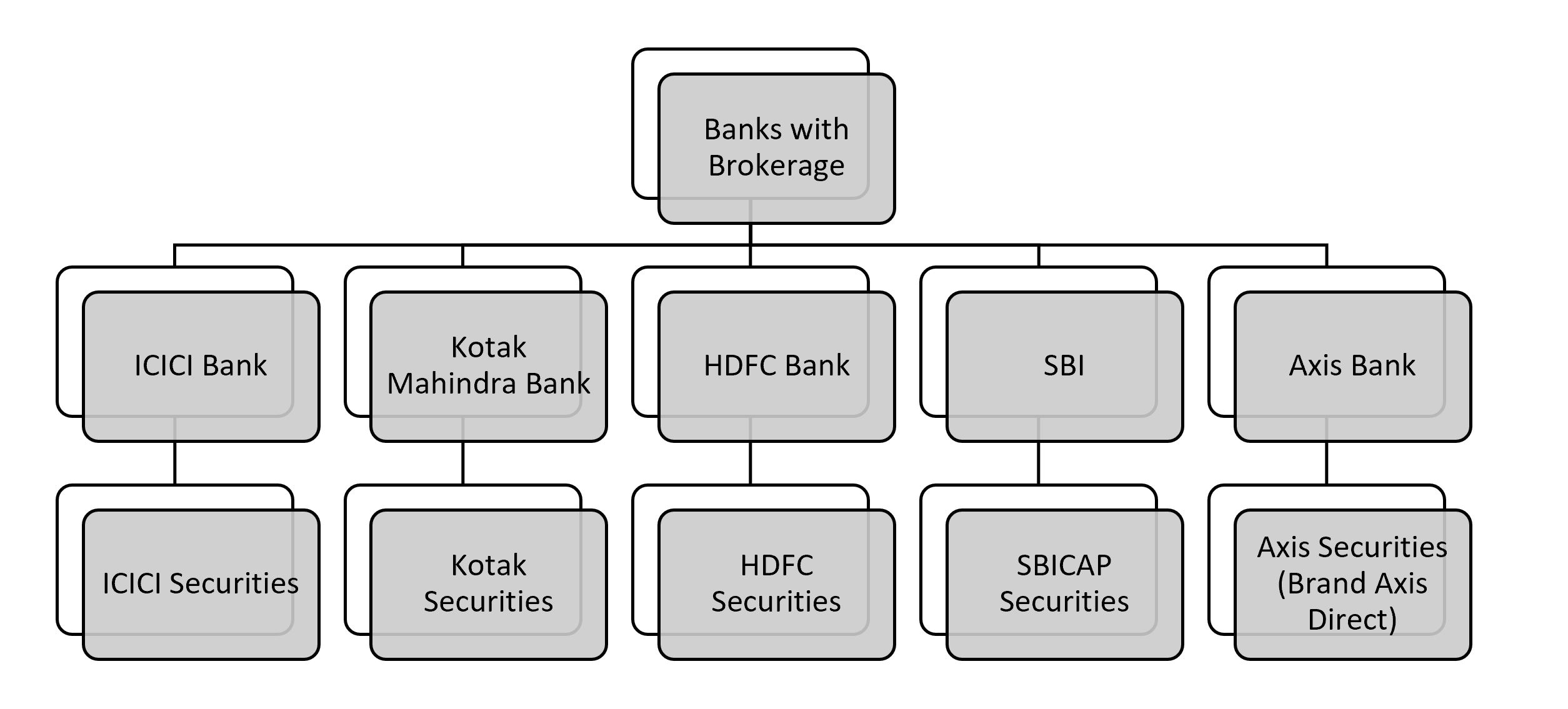

Historically, it has been a trend to open a brokerage account with the bank one is invested in, and it persists to this date. Most of the nationalized banks have their brokerage arm. They sign up people in their brokerage accounts when opening a bank account using the integrated account facility. Here are some of the banks and their corresponding brokerage accounts

Once you activate the brokerage account with these guys, you get a basket of services starting from your investment manager's calls who will provide you tips on where to invest, research reports giving detailed information on companies, and other myriad offerings across insurance, mutual fund, wealth management, etc. However, there is no free lunch in the world, and the shock hits you when you begin transacting and see the contract notes coming in. The average brokerage being charged falls in the 0.5-1% of the transacted amount. For e.g., if you were to invest worth INR 1,00,000/- you will end up paying brokerage of about INR 1,000 to complete the transaction leading to an investment of only INR 99,000. It gets worse for short-term and intraday traders who have paid a lot more due to their trading volume. In trading and investing, costs matter, and they often add up and compound, thus eating into your gains. At this stage, the search for a lower cost broker begins.

The drive to provide people access to the markets and to do so at a low cost spurred on a young trader, Nithin Kamath, who started his brokerage firm in 2010. He named it Zerodha, derived from the words "zero" and "rodha," with the latter being a Sanskrit word for obstructions. In 10 years, it has made its journey from a startup to one of the largest and best brokerage firms in the country, offering zero brokerage equity investments and extremely low cost and fixed price trading brokerage. The launch of Zerodha led to the split of the brokerage segment in India into two categories: Full-Service Broker and Discount Broker. All the bank-related brokerages and those independent but providing their research and investment services like Motilal Oswal and Anand Rathi were called full-service brokers. Brokers like Zerodha, who just offered a trading and transacting platform, low brokerages, and let the investors and traders take their own decisions, came to be known as discount brokers. Let us try and understand their differences.

| Description | Full Service Broker | Discount Broker |

|---|---|---|

| Business Model | Full bouquet of services including research, advisory, investment manager etc. | No frills trading and transaction platform. No additional services |

| Brokerage | High (0.5%-1%) and volume based. I.e. a percentage of volume transacted | Low (0.03%) to fixed flat fee like INR 20 for Zerodha |

| Brokerage Variation | Based on volume and lower volume incurs higher brokerage | Flat brokerage irrespective of volume benefiting low volume traders |

| Equity Investing brokerage | Charge a brokerage up to 1% of investment amount | Free across most discount brokers but otherwise a small nominal charge |

| Trading Platform | Old school, slow and legacy trading platforms although they are now improving | State of the art trading platforms with advanced analytical tools and charts |

| Leverage (SEBI rules have now eliminated this via its new regulations but used to be an important distinction) | High leverage and high margin trading | Relatively lower leverage |

| Offline Trading | Have call & trade facilities, access to an investment manager and several dealers | Offer call & trade facilities but it is not that great |

So how does one go about choosing a discount broker?

While costs are the primary reasons for selecting a discount broker, one must remember that cheap is not always good. Other than costs, one must also look at the stability and reliability of the broker. You do not want the broker to run away with your money, do you? Nor do you want the trading platform to crash the moment the market crashes. Here are a few things one must check and verify before selecting a discount broker:

- Stability of platform: The frequency of complaints regarding crashes are a good indicator

- Reliability of broker: Is the money being returned to client accounts are shares being deposited in Demat accounts with NSDL and CDSL.

- Hidden costs: Are there hidden costs associated with leverage or margin funding

- Customer Support: How responsive is the customer support? Are problems being resolved quickly? Is Customer support reachable during a crisis?

- Trading Platform: Does it have access to live data and sufficient analytical tools, is it upgraded frequently to keep pace with changing developments

The journey to successful investing begins with chasing profits and ends with the realization that costs matter and need to be controlled. As such, discount brokers help assist in this feature, and the best brokerage firm in India , Zerodha, with its free equity investments, offers the perfect platform to begin the process of successful investing. There is no perfect time than the present to begin investing, and you can open the account here .